Are you ready for MTD?

Tax Digital for Income Tax Self-Assessment Delayed

Making Tax Digital for income tax self-assessment may still be 18 months away, but if you are self-employed or a landlord, it is time to get ready for digital record keeping, ahead of the deadline. MTD ITSA (Making Tax Digital for income tax self-assessment) is set to begin on 6 April 2023, and it looks like businesses will need to enter the new regime from the first accounting period commencing on or after 1 April 2023; the proposed basis period rules deem an accounting period ending on 31 March as ending on 5 April.

More than four million taxpayers are set to start MTD ITSA from 6 April 2023, and the current timetable has met fierce opposition. The limited nature of the pilot scheme has not helped.

How MTD ITSA will work

MTD ITSA will initially apply to the self-employed and landlords with total annual turnover exceeding £10,000. There is no exclusion if you have, say, £6,000 of trading income and £6,000 of rental income. Income and expenditure will have to be recorded digitally. Spreadsheets are fine, but, if you do it yourself, MTD-compatible software will be needed to submit quarterly updates.

A quarterly summary of income and expenses must be sent to HMRC, with a final declaration replacing the self-assessment tax return. There will be a new penalty system and no soft landing. However, a late filing penalty will not apply until four quarterly submissions are late. The biggest impact will be for those currently maintaining paper records. A move to spreadsheets should not be too onerous, however, and it will then be fairly straightforward to use these as a basis for the filing requirements. If you are thinking of moving to a software package, be warned there are currently only seven providers of suitable software. HMRC has issued guidance on MTD ITSA and of course, we’re here to help.

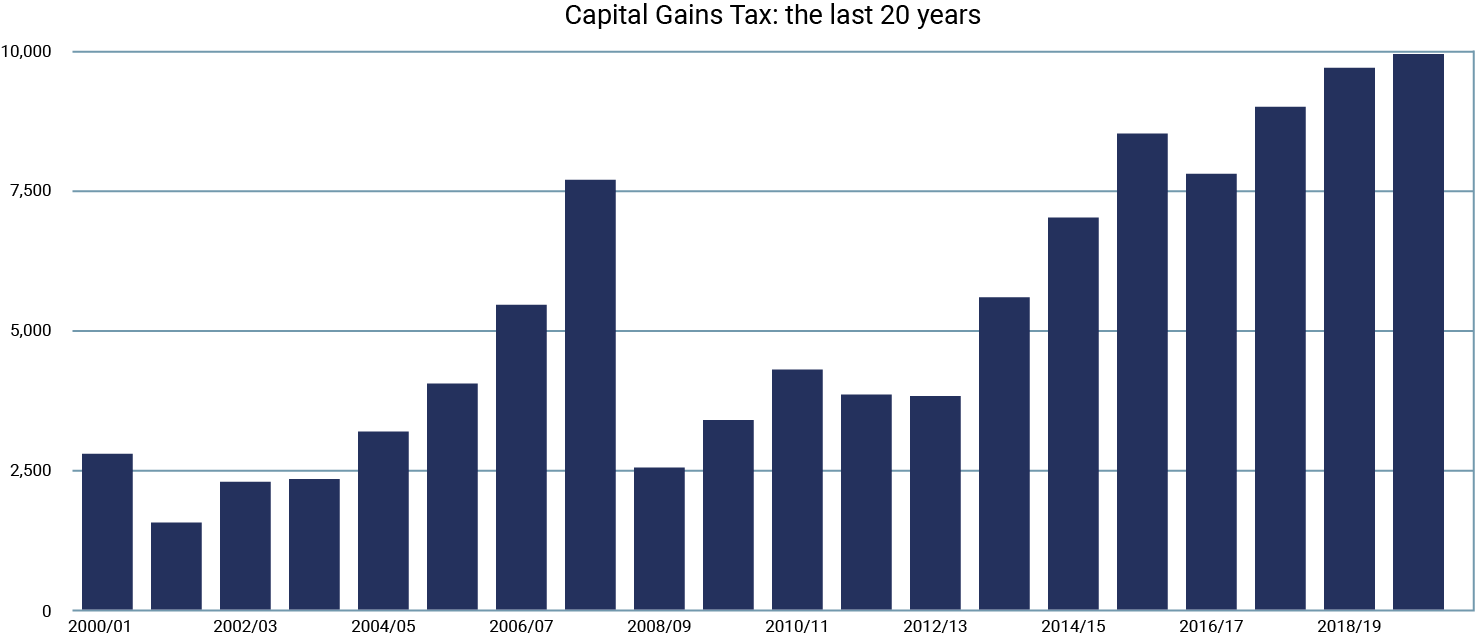

Capital gains tax receipts underline tempting target for Chancellor

New HMRC data shows that in 2019/20, £9.9 billion of capital gains tax (CGT) liabilities were created.

Source: HMRC

In July last year, the Chancellor unexpectedly asked the Office of Tax Simplification (OTS) to review “capital gains tax (CGT) and aspects of the taxation of chargeable gains in relation to individuals and smaller businesses”. The top tax rate currently sits at 28% (limited to residential property and carried interest) with 20% liability for other assets.

At the time, there was speculation that Rishi Sunak was looking at CGT as a way of raising extra revenue without breaking the Conservatives’ 2019 manifesto pledge not to increase rates for income tax, VAT and national insurance. With those receipts of nearly £10 billion, it’s certainly a tempting target.

The OTS produced its first report on simplifying the design of the tax last November, prompting the rumour mill to forecast that CGT changes would appear in the spring Budget. However, CGT barely received a mention in March beyond the freezing of the annual exemption for five tax years at the 2020/21 level of £12,300. In May 2021, the OTS issued a second report examining “practical, technical and administrative issues” of making changes to CGT.

The focus for CGT announcements is now on the next Budget. In theory, it is due in autumn, but in practice, it could once again be delayed until spring. By then, the economic landscape should be clearer as pandemic support measures cease and we will have weathered another winter of Covid-19.